The better than expected April Jobs Report sent Bond prices plunging Friday, but the safe haven trade emerged in a big way on escalated tensions between Russia and Ukraine around 10:00am ET. Non-farm payrolls came in at 288K, above the 210K expected, while the Unemployment Rate fell to 6.3%, lowest since September 2008. But all was not rosy within the report, the Labor Force participation Rate fell to 62.8%, matching a 35-year low, 806,000 Americans dropped out of the workforce bringing the total amount of workers of people out of the work force to more than 92 million. The 4% coupon closed at 105.06 up 12bp and up 53bp for the week. Stocks fell on the Ukraine news – the Dow ended the week at 16,512.89 down 52.46 points, the S&P 500 lost 2.54 points to 1,881.14 while the Nasdaq was lower by 3.54 points to end at 4,123.89. All of the major Stock Indexes ended the week modestly higher. Oil was last seen at $99.78/barrel up 36 cents.

We will recommend to float into the weekend. However, remember that bonds are again at the year highs and highs seen in June ’13 and November ’13, which has been a tough resistance level.

Fed tapers another $10B

Despite a backdrop of slowing first-quarter economic activity, the Federal Reserve voted Wednesday to continue reducing its monthly stimulus program.

In a move that met market expectations, the U.S. central bank cut back its bond purchases to $45 billion a month, which is $40 billion less than the original total in a program that has swelled the Fed balance sheet to more than $4.3 trillion.

The decision came as recent signs showed that first-quarter growth was even weaker than expected. The Commerce Department reported Wednesday that gross domestic product increased just 0.1 percent, a full percentage point below expectations. Read more

Weekly Survey of Rates from the Mortgage Bankers Association

For the week of April 30th 2014-

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.49 percent, with points decreasing to 0.38 from 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) decreased to 4.37 percent from 4.41 percent, with points decreasing to 0.14 from 0.34 (including the origination fee) for 80 percent LTV loans.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.53 percent from 3.55 percent, with points decreasing to 0.31 from 0.33 (including the origination fee) for 80 percent LTV loans.

Commercial Real Estate Lending

Commercial Mortgage backed Securities (CMBS)– The 10 Yr Swap rate moved lower to finish the week at 2.766%, up from last weeks 2.732%.

Housing News

12,575 Homes Sold yesterday

If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality.

After all, 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575! That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day.

If you are considering whether or not to put your house up for sale, don’t let the headlines scare you. There are purchasers in the market and they are buying – to the tune of 12,575 homes a day.

Home sales finally thaw, but just slightly

U.S. home buyers signed more contracts to buy existing homes in March, as weather in much of the country warmed and as more listings came onto the market. An index of so-called “pending” home sales from the National Association of Realtors rose 3.4 percent from February, the first gain in nine months, but is still down 7.9 percent from March of 2013. Read more

Home prices up 0.8 percent in February: S&P/Case-Shiller

U.S. single-family home prices rose in February and slightly beat expectations, a closely watched survey said on Tuesday.

The S&P/Case-Shiller composite index of 20 metropolitan areas rose 0.8 percent in February on a seasonally adjusted basis. A Reuters poll of economists had forecast a 0.7 percent rise. “Despite continued price gains, most other housing statistics are weak,” said David Blitzer, chairman of the index committee at S&P Dow Jones Indices, who cited new and existing home sales data.

“The recovery in housing starts, now less than one million units at annual rates, is faltering. Moreover, home prices nationally have not made it back to 2005.” Read more

Economic News

Consumer confidence hit 82.3 in April, according to the Conference Board, down from a reading of 83.9 in March. Economists polled by Reuters had expected a consumer confidence reading of 83.

China is set to become World’s largest economy by years end, overtaking U.S.

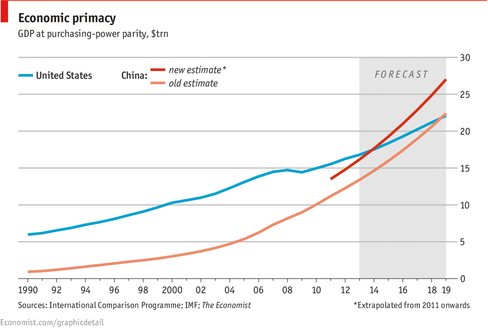

UNTIL 1890 China was the world’s largest economy, before America surpassed it. By the end of 2014 China is on track to reclaim its crown. Comparing economic output is tricky: exchange rates get in the way. Simply converting GDP from renminbi to dollars at market rates may not reflect the true cost of living. Bread and beer may be cheaper in one country than another, for example. To account for these differences, economists make adjustments based on a comparable basket of goods and services across the globe, so-called purchasing-power parity (PPP). New data released on April 30th from the International Comparison Programme, a part of the UN, calculated the cost of living in 199 countries in 2011. On this basis, China’s PPP exchange rate is now higher than economists had previously estimated using data from the previous survey in 2005: a whopping 20% higher. So China, which had been forecast to overtake America in 2019 by the IMF, will be crowned the world’s pre-eminent country by the end of this year according to The Economist’s calculations. The American Century ends, and the Pacific Century begins.

US private sector jobs total 220,000 in April vs. 200,000 estimate: ADP

The number of jobs created in the U.S. private sector in April totaled 220,000. Economists had expected ADP’s national employment index to show the economy created 200,000 jobs in April, up from March’s 191,430 reading.

US first-quarter GDP up 0.1% vs. 1.2% estimate

U.S. first-quarter gross domestic product grew at a 0.1 percent annual rate. GDP had been expected to grow at a 1.2 percent annual rate, according to a Reuters survey of economists, pulling back from the fourth quarter’s 2.6 percent pace.

Payrolls jump in April as thaw hits jobs market

Job creation accelerated in April as the U.S. economy added 288,000 new positions, while the unemployment rate plummeted to 6.3 percent amid a sharp drop in the workforce. Read more

Factory orders rose for a second straight month in March, climbing 1.1 percent, suggesting strength in manufacturing and the broader economy at the end of the first quarter. Economists were predicting a gain of 1.5 percent, according to a Reuters estimate.

Sources: CNBC, Bloomberg, Reuters, Housingwire, KCM, MMG, The Economist